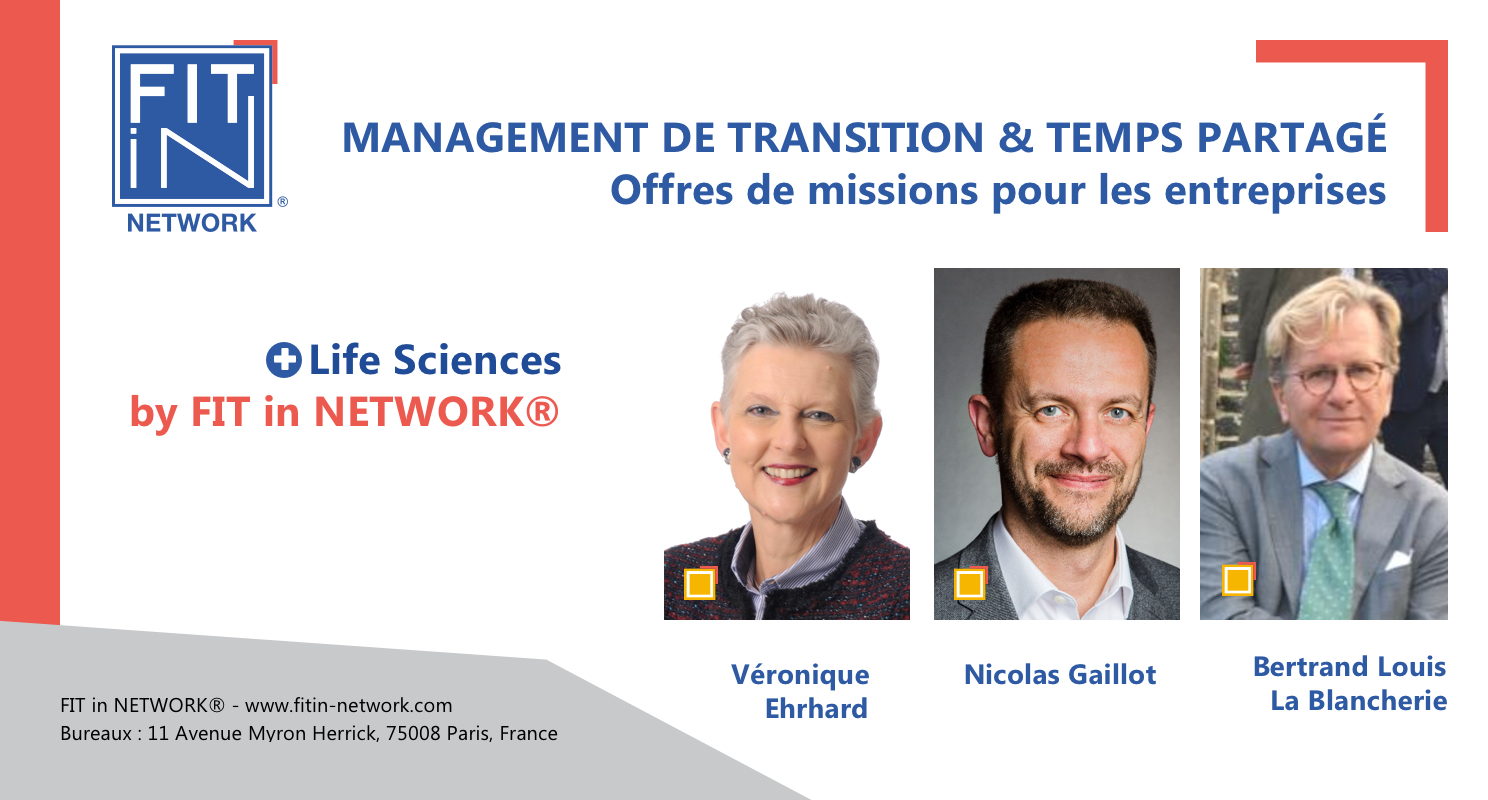

Offre de mission Life Sciences by FIT in NETWORK®

Our findings

The fight against Covid has brought the attention of public authorities and populations back to the health industries. In the short term, this reinforces

Image issues for the entire sector in France, whose economic model is stigmatised, at a time when “socially responsible” companies are becoming more and more commonplace.

The interventionism of public actors around the stakes of independence in human health around:

- The relocation at European / national level of certain IPA production chains (active ingredients).

- The financing of innovation, whose previous models no longer work for new types of treatment.

- Product life cycles, by acting on the reimbursement of treatments (generics, T2A, etc.).

In addition, this period accelerated pre-existing sectoral developments:

- Reinforced and diverse interdependencies between “majors” on the one hand and Biotech / Medtech start-ups on the other. There is also a growing interest of investment and venture capital funds in these fields;

- The sector will thus remain in permanent restructuring due to a double movement:purchase / integration of Biotech by the ” Big pharmas ” and consolidation by merger of the latter. These M&A deals will be increasingly confidential for reasons of image and responsibility;

- Digital, which has already revolutionised the heart of the Medtech business, is also having an impact on the pharmaceutical industry. The promotion and distribution chain is being overhauled, with on the promotion side, the gradual disappearance of part of the medical visit in favour of dematerialised contacts.

- On the distribution side, a major risk linked to the worldwide sale of counterfeit health products via the Internet – which has exploded during the pandemic (hydro alcoholic gels, masks, antivirals such as Chloroquine…).

- Still linked to digital, but more visible to the public, the emergence of e-health: applications, and boom in teleconsultations … The storage and processing of health data have become major political (regulatory), technical (development of AI) and economic (arrival of the GAFA) issues. This should further accelerate the evolution of the western medico-economic model from a logic of mass treatment to a logic of individualised prevention. This change is already at work, with patients becoming more and more “actors” in their own health, whose quest for information is shaking up the roles of care providers, manufacturers and distributors (pharmacists);

The concomitance and scale of these changes are challenging organisational modes, putting certain skills under strain, but above all creating new needs for agility.

Our vision

The permanent restructuring movements inherent in the sector will continue: consolidation/merger of “big pharma” and acquisition/integration of small and mid-cap Biotech. At the same time, new forms of cooperation and cross-fertilisation are to be invented with the emergence of new players: Biotech reaching the industrial stage thanks to unprecedented financing, technology giants developing AI for pharmaceutical formulation etc…

But once again, it is the state and regulatory actors whose future attitude generates the most uncertainty:

- What real effort will be made to relocate API production, which would be a major opportunity for pharmaceutical subcontracting (CDMOs) and fine chemicals?

- What research funding model will be used, induced by the public policies of reimbursement and promotion of generics?

- What latitude in the circulation and processing of health data and in transparency vis-à-vis the various players (researchers, manufacturers, distributors, practitioners, patients)?

- What role should be given to the promotion of health products without unbalancing treatment systems?

- What barriers to counterfeiting and what level of protectionism are offered by regulatory measures that systematically play in favour of the “majors”?

In addition to these uncertainties about the players and the rules of the game, there are also uncertainties about the new technical opportunities offered by

- Digital: e-health modifying the role of each actor in the care chain and the logic of care;

- New treatment methods: allowing personalised but expensive preventive treatments that challenge established reimbursement nomenclatures and call into question fragile economic balances.

In the end, the Covid crisis will have highlighted the many uncertainties weighing on the sector and the complexity of the issues at stake in the coming months. In this context, all the players will have to demonstrate unprecedented adaptability and agility over short periods of time – breaking with a Life Science culture based on the elimination of risks and the long term.

Complexity and uncertainty, however, present as many opportunities as they do threats, provided you have the appropriate, experienced and available business resources capable of complementing your teams in order to approach these subjects in a totally multidisciplinary manner. We have the resources to help you meet these challenges.

Our proposed solutions for interim management assignments

We offer multi-disciplinary interim management solutions involving Premium Experts who are specialists in your sector, either individually or – and this is our strength – in the form of a “multi-disciplinary task force”.

1. Support for structuring deals

– Occasionally reinforcing the teams of an investment fund or an industrial company throughout an M&A and integration process, licensing (carve in or carve out) or commercial contract negotiation. Target research, business plan & valuation, participation in negotiations and due diligence in the strategic, financial and human dimensions; development of partnerships with start-ups or creation of a start-up ecosystem. Adjustment of organisations and resources within the : new “make or buy” trade-offs;

Diversification/relocation of supply sources – in particular of IPAs;

International footprint adjustments to optimise economic / technical / HR / financial performance and external funding sources;

organisational changes impacting the volume and qualifications of jobs: overhaul of downstream Supply Chain, sales teams and distribution channels;

changes in tools and project team management.

2. Ad hoc contribution of expertise on digitisation processes

Discover our video 👉 https://youtu.be/T1AZlCG_Fxc

Download our offer 👉 FIT in NETWORK® – Life Sciences

|

|

|

|

Chief Financial Officer |

Director of Human Resources |

CEO |

Would you like to discuss your expectations and your support?

Contact our Premium experts to talk about it and agree on the best tailor-made solution for your company. Our three business experts can inform you and also direct you to one of our 1500+ experts referenced and visible on our FIT in NETWORK® platform!

Contact